estate trust tax return due date

Form 1040 for Individuals 18th April 2022. If you opt to use a short year for the final return dont forget that the return is still due three and one-half months after the end of the year youve chosen.

Printable 2020 W9 Form Free Irs Forms Fillable Forms Tax Forms

This doesnt extend your time to pay.

. When the estate or trust receives income earned. Trust and Estate Partnership. The extension is automatic.

Step-By-Step Guides to Avoid Tax Penalties and Close the Estate Effectively. Due dates and mailing addresses Estates. According to the IRS estates and trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year 7.

Due date for third installment of 2022 estimated tax payments October 17 2022 Final deadline to file your 2021 calendar-year estatetrust tax return if you filed an extension Final deadline to file your C corporation tax return if you filed an extension October 17 2022 Final deadline to file your 2021 personal tax return if you filed an extension. September 15 would be the fifteenth day of the fourth month following that date. For trusts operating on a calendar year the trust tax return due date is April 15.

Once you set the closing date you have 35 months after that to turn in the return. When calculating the size of an estate the. You should also pay any balance owing no later than 90 days after that year-end.

Reporting Excess Deductions on Termination of an Estate or Trust on Forms 1040 1040-SR and 1040-NR for Tax Year 2018 and Tax Year 2019 --10-JUL-2020. Ad Access Tax Forms. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Federal estate tax returns are due no later than 9 months after the deceased persons date of death. Due date of return. Complete Edit or Print Tax Forms Instantly.

The due date is April 18 instead of April 15 because of the Emancipation Day holiday in the District of Columbia even if you dont live in the District of Columbia. California Fiduciary Income Tax Return form FTB 541 California Fiduciary Income Tax Return booklet FTB 541 BK Visit Forms to get older forms. Form 4868 doesnt need to be filed if no tax is due.

Estate transfer tax is imposed when assets are transferred from the estate to heirs and beneficiaries. Due Date For Filing. For trusts on a fiscal year the trust tax return filing deadline is the 15th day of the fourth month following the close of the tax year.

The federal fiduciary income tax return is typically due by the 15th day of the 4th month following the end of the estates taxable year. Form 1120 for C-Corporations 18th April 2022. Form 1120S for S-corporations 15th March 2022.

Ad Step-By-Step Guides to Help Administer the Estate and Avoid Tax Penalties. Supplemental forms such as 706-A 706-GS D-1 706-NA or 706-QDT may also need to be filed. Income distributions are reported to beneficiaries and the IRS on Schedules K-1 Form 1041.

The return is required to be filed on or before April 15 if on a calendar year basis and on or before the 15th day of the fourth month following the end of the fiscal year if on a fiscal year basis. The estates income is 9500 which is below the tax-free threshold. Unlike personal tax returns trust tax returns have more than one due date.

Due Date for Estates and Trusts Tax Returns. The tax return and payment are due nine months after the estate owners date of death. A trust or estate with a tax year that ends June 30 must file by October 15 of the same year.

Form 1041. Schedule K-1 Form 1041 InstructionsCorrected Decedents Schedule K-1 -- 29-JAN-2021. For Marees estate income year one is 5 March 2022 to 30 June 2022.

An estate administrator has the option of either setting the trust up on a calendar. Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. 3-12 months after the year-end of the estate or trust.

The Form 1041 will recognize 10000 of taxable income and tax will be paid accordingly and Beneficiary A will report 20000 of income on his personal income tax return. You must fill in the dates of the short year at the top of the return. Income from membership of Lloyds.

For example for a trust or estate with a tax year ending December 31 the due date is April 15 of the following year. If the estate instead distributes 10000 to the trust then the trusts share of income is 30000 20000 plus the 10000 from the estate. Fin CEN 114 FBAR.

13 rows Only about one in twelve estate income tax returns are due on April 15. According to the IRS for those who passed away in 2020 an estate tax return IRS Form 706 must be filed if the size of the deceaseds gross estate plus any taxable gifts made during the deceaseds life exceeds 1158 million this amount increased to 117 million for those who die in 2021. In this income year.

This covers Marees income from 30 June 2021 to 4 March 2022. So if you elect to end the year on November 30 your short-year return is now due on March 15 not April 15. 31 for instance that gives you until April.

Calendar year estates and trusts must file Form 1041 by April 18 2022. Blank Forms PDF Forms Printable Forms Fillable Forms. Zach lodges a date of death individual tax return for Maree.

Income Tax Return for Estates and Trusts. If you live in Maine or Massachusetts you have until April 19 2022. If you pick Dec.

Trust and Estate UK Property. If you need more time to file use federal Form 4768 for a six-month extension. For Uncle Bartholomew if the tax year began in June when he died it would end on May 31 of the subsequent year.

When filing an estate return the executor follows the due dates for estates. Deceased estate trust tax returns. Most trusts are required to use a December 31 year end but estates may.

If your fiscal year begins on April 1 your first payment will be due on July 15. The first payment for a fiscal year filer must be filed on or before the 15th day of the 4th month of the fiscal year. Please note that the.

For fiscal year estates and trusts file Form 1041 by the 15th day of the 4th month following the close of the tax year. Form 1041 for Trusts and Estates 18th April 2022. For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or before April 15 of the following year.

It depends on the value of the estate. Ad Dedicated Financial Professionals Can Help With Estate Wealth Management. File an amended return for the estate or trust.

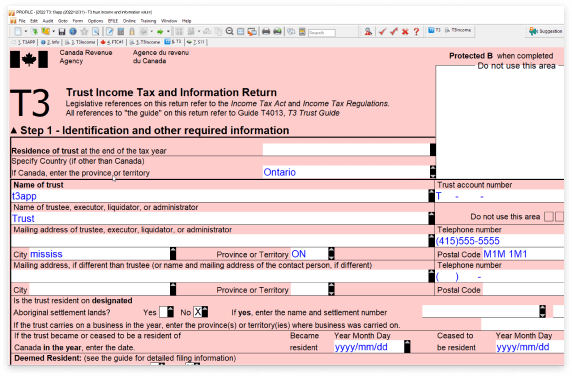

Filing dates For a T3 return your filing due date depends on the trusts tax year-end. Form W-2 W3 1099 NEC and 1096 NEC. The estimated tax is payable in equal installments on or before April 15 June 15 September 15 and January 15.

Refer to IRS Form 706. Easily Download Print Forms From. The estate income tax return is due on the fifteenth day of the fourth month after the end of the tax year.

31 rows Generally the estate tax return is due nine months after the date of death. Trust tax return due date. Trust and Estate Trade.

Ad trust tax return due date. Estates or trusts must file Form 1041 by the fifteenth day of the fourth month after the close of the trusts or estates tax year. 3 However not every estate needs to file Form 706.

In one calendar year you have to file a T3 return the related T3 slips NR4 slips and T3 and NR4 summaries no later than 90 days after the trusts tax year-end. Form 1065 for Partnerships 15th March 2022.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Cra T1135 Forms Toronto Tax Lawyer

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Today If Not Done So Already Non Profits May Still Want To Take A Few Moments To File 990 S Even Th Irs Taxes Internal Revenue Service Estimated Tax Payments

Welcome To Black Ink Tax Accounting Services We Hope To Provide You With Timely And Valuabl Accounting Services Tax Preparation Services Offer In Compromise

Image Result For Will Template Free Online Uk Last Will And Testament Will And Testament Estate Planning Checklist

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Exploring The Estate Tax Part 2 Journal Of Accountancy

Florida Last Will And Testament Form Last Will And Testament Will And Testament Estate Planning Checklist

T3 Trust Tax Preparation Cra Efile Software Profile

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

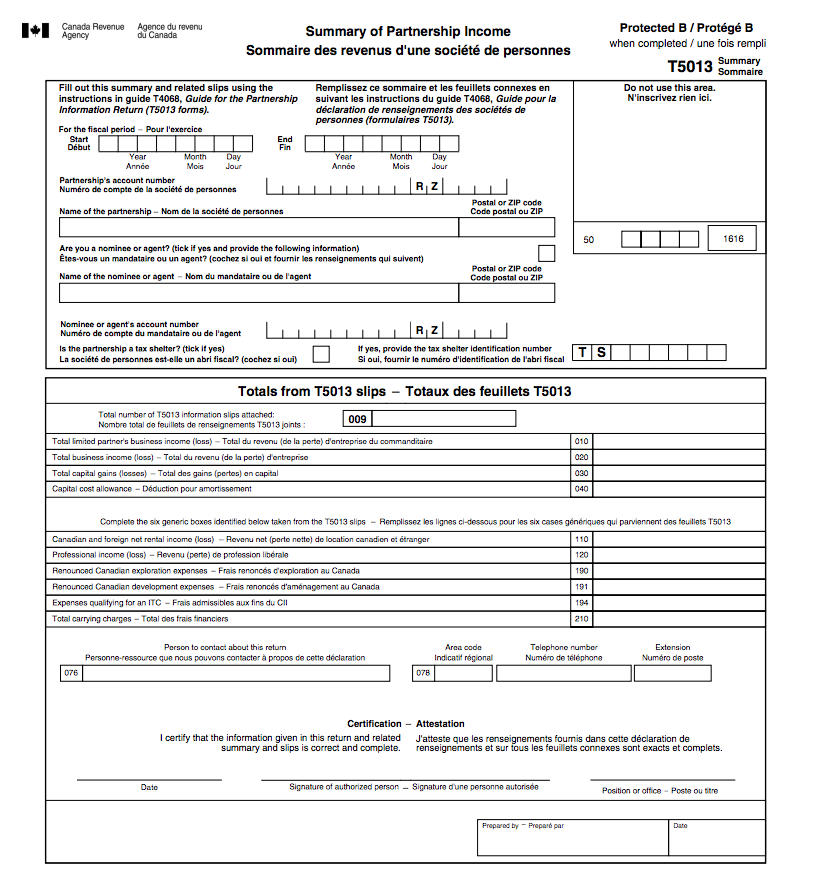

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

2022 Canada Tax Checklist What Documents Do I Need To File My Taxes 2022 Turbotax Canada Tips